Strategic Pricing

Pricing decisions are frequently made based on isolated variables rather than a strategic view of the market and company. The difference between setting prices and pricing strategically is “the difference between reacting to market conditions and proactively managing them.” There are many important considerations for pricing that go beyond near-term profitability and immediate pricing problems such as competitive reactions, marketing strategy, and alignment with sales and marketing programs.

The The Strategy and Tactics of Pricing by Thomas Nagle and John E Hogan

The Strategy and Tactics of Pricing is one of the best books available on pricing because it gives a comprehensive and detailed view of all issues which should be considered when pricing products and services. The authors are so adamant about strategic pricing that they write: “Abdicating responsibility for pricing to the sales force or the distribution channel is abdicating responsibility for the strategic direction of the business.” In strategic pricing, prices are not set at the end of the product development process, rather the price is determined in line with all other elements of the solution being brought to market–“the only way to ensure profitable pricing is to reject early those ideas for which adequate value cannot be captured to justify the cost.” Instead of building the product first and handing off price setting to a different team, the price should be identified early on based on knowledge of customers and value and a product designed to support that price.

The reason pricing is ineffective is frequently not that the pricers have done a poor job. It is that decisions were made about costs, customers, and competitive strategy without correctly thinking through their broader financial implications.

Strategic pricing is the coordination of interrelated marketing, competitive, and financial decisions to set prices profitably.

Nagle situates pricing in the intersection between marketing and finance which “involves finding a balance between the customer’s desire to obtain good value and the firm’s need to cover costs and earn profits.” Marketing and sales managers, who should be in the best position to understand the value a company provides to its customers, must operate within and understand financial objectives. Conversely, financial managers must take a broader perspective than just covering costs. Profitable pricing is a result of a collaboration between the sales/marketing function (what is the value of the product to the customer?) and finance (what are the financial constraints required for profitability?).

Currently, the pricing function resides in several corporate departments–an August 2012 survey by the Professional Pricing Society found that 26% of pricing professionals report to top management with 34% residing in marketing and 20% in finance. Strategic pricing would have marketing and finance work closely together.

The problem with cost plus pricing

Cost plus pricing is based on the assumption that costs can be easily identified and allocated evenly as volume changes. In this model, fixed costs are allocated over a given unit volume; however, because price affects volume sales, the unit cost is a moving target. Attempting to use the cost-based price as a starting point is also futile–no one wants to raise prices regardless of sales volume. A vicious cycle results if volume decreases because now fixed costs must allocated over a smaller number of units. This results in overpricing in a weak market. Conversely, in growing markets, as volume increases, prices are decreased because fixed costs are allocated to a larger number of units, causing underpricing in a strong market.

Instead, two questions should be asked:

- How much more sales volume must we achieve to earn additional profit from a lower price?

- How much sales volume can we lose and still earn additional profit from a higher price?

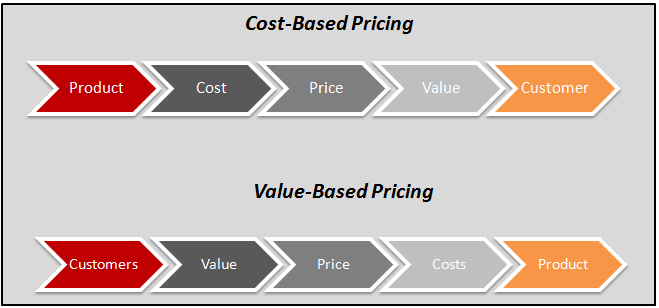

Cost based pricing is founded on faulty logic because sales volume, which is the beginning assumption, depends on price, which is the outcome of the process. Rather, pricing managers should determine cost (based on value) first and then calculate price. This is the only way to break the cost-plus conundrum. Cost-based pricing is product driven: a product is designed, costs are incurred, and then finance is brought into the process at a later stage to determine fixed costs and allocating them across a projected sales volume. Marketing is then given the task of demonstrating value to customers.

Strategic pricing questions

It is the pricer’s job to work back from the price to understand the problem

Strategic pricing questions begin with the price, but quickly moves on to the broader business and marketing context:

- Is the price unprofitable because there is a better price to charge, or because the value has been ineffectively communicated?

- Is the market share goal too high, or is the market inadequately segmented?

- Is the product and service offering overbuilt (and therefore too expensive) for the value it delivers, or has the seller simply enabled customers to avoid paying for the value they get?

Asking each of these questions pulls the focus up from the price itself and encourages the business team to look at downstream go to market and upstream product and service design questions. Rather than using blunt force (to increase margin, raise the price; to make the sale, cut the price), strategic pricing questions are broader and more open-ended. Likewise, strategic pricing is cross-functional, and is not limited to a single discipline or department.

Profitable prices cannot be driven by a cost number with little or no understanding of how customers might respond, or by a customer’s demands with little or no information about how competitors might respond, or by a market-share goal with little or no understanding of the company’s ability to win a price war.

Key inputs to the pricing process include cost information (cost structures, cost levels, ROI parameters), competitor capabilities and intentions, and economic value from the perspective of the customer. This information must be integrated and applied against target customer segments and pricing objectives to determine the value-based pricing structure and segment-specific product variations. This flow puts pricing in context of product development and go to market decisions and eliminates myopic and reactive price setting.

Pricing for profitable growth in consumer markets

Strategy very often goes out of the window when it comes to competition

The participants of this panel discuss passing along input costs to consumers in a commodity market (consumer packaged goods in this case). Georg Muller recommends first looking across the entire value chain and asking: “what would happen if I passed along cost increases?” If that’s not possible, there may be options such as reformulating or resizing the product to make it cheaper to manufacture. Andrew Thomas says not to “send a shock to the system” by taking something away from the consumer in the process of changing the product and/or price. Nagle notes that if the whole market is raising costs in response to input price increases it is easier for any individual company to raise its prices; however, if competitors are not raising costs, it is difficult to step forward and be the first. The end consumer and your channel partners will resist raising prices purely for profit gains.

Nagle says that strategy is tossed aside when a competitor refuses to lower prices. In this case, he recommends stepping back and asking “what is the role of price in their strategy and what is the role of price in my strategy?” Market share becomes and important consideration because a market share leader may not want to do battle based on price against a smaller share company. Conversely, if two large share leaders go head to head, it may make sense to match one another’s pricing in order to avoid losing market share. Considering the whole marketing strategy, larger, national firm can raise ad spending in response to a regional competitor’s price decrease. Nagle says, “don’t assume that if [the competitor] picks price, I should also pick price”. The moderator summarizes by saying the best strategy is to compete in areas where you have the advantage and not in those, even if it’s price, where you do not.

Pricing Policies

Nagle says that companies should centralize pricing authority within a cross-functional team of Operations, Finance, and Sales in order to create a set of thoughtful pricing policies. Rather than assigning discounting thresholds by seniority (e.g., district manager can discount by 15%, VP of Sales can discount by any amount), companies should have clear pricing policies that empower anyone in the sales organization to provide discounts given definitive criteria. This enables the sales team to work closely with the customer to create win-win deals rather than respond to customer discounting pressure with “I have to talk to my boss” because the customer asked for a discount greater than what the sales person has authority to provide. Pricing policies also enable the company to proactively approach discounting through a focus on profitability rather than re-actively discounting in order to win volume.

Understanding Discounting Behavior

Pricing managers must balance the need to sell a piece of business and capture the value

Reed Holden (who wrote Pricing with Confidence: 10 Ways to Stop Leaving Money on the Table) discusses key pricing issues. He observes that although technology is now available to pricing managers with which to manage and understand discounting behavior and price sensitivity, this capability is counterbalanced by well-informed and sophisticated customers who are adept at getting discounts. He says managers need to understand and remedy their discounting behavior by: 1) drawing a line in the sand and “firing some of their customers” who should not be receiving discounts; 2) go on a “value hunt” to understand the value their product provides; and 3) compensate the sales force for profitability rather than volume. Again, pricing is viewed not in isolation of an imminent deal, but within a broader context of customer value, corporate profitability, and future sales opportunities.